zhustudio.online

Tools

Best Bank Account To Make Money

Learn about the benefits of a Chase checking account online. Compare Chase checking accounts and select the one that best fits your needs Give feedback Opens. Money market accounts take the best aspects of checking and saving accounts and combine them into one offering. You're generally eligible for higher-than-. Note: TotalBank is available to customers nationwide except for Florida residents. Note: Although this account has "money market" in its name, it offers no. Switching to a new current account is quick, easy and can earn you up to £ in free cash. Yet you can get plenty of perks without switching bank account. Open an eligible checking account, and earn a cash bonus after completing required activities. We're honored to be named a Kiplinger's Best Bank seven years. A high-yield checking account is a smart way to earn some money on your income in the short time it remains there, until you divy it up between savings. High-yield savings accounts – whether at a traditional bank, credit union or online bank – give you a much higher annual percentage yield on your deposits. In. Cash back deals. Want to put more in savings? Search participating merchants and earn up to 10% cash back on everyday purchases. Learn more about. Alliant Credit Union · Ally Bank · Axos Bank · Bank of America · Bank5Connect · Barclays · Bethpage Federal Credit Union · Bread Financial. Learn about the benefits of a Chase checking account online. Compare Chase checking accounts and select the one that best fits your needs Give feedback Opens. Money market accounts take the best aspects of checking and saving accounts and combine them into one offering. You're generally eligible for higher-than-. Note: TotalBank is available to customers nationwide except for Florida residents. Note: Although this account has "money market" in its name, it offers no. Switching to a new current account is quick, easy and can earn you up to £ in free cash. Yet you can get plenty of perks without switching bank account. Open an eligible checking account, and earn a cash bonus after completing required activities. We're honored to be named a Kiplinger's Best Bank seven years. A high-yield checking account is a smart way to earn some money on your income in the short time it remains there, until you divy it up between savings. High-yield savings accounts – whether at a traditional bank, credit union or online bank – give you a much higher annual percentage yield on your deposits. In. Cash back deals. Want to put more in savings? Search participating merchants and earn up to 10% cash back on everyday purchases. Learn more about. Alliant Credit Union · Ally Bank · Axos Bank · Bank of America · Bank5Connect · Barclays · Bethpage Federal Credit Union · Bread Financial.

Make your short- and long-term goals a reality with a variety of savings options from U.S. Bank. Open a new Elite Money Market Account today and earn a. Make deposits,6 check balances, move money, and use Zelle®,7 Apple Pay,8 or How do I make my initial deposit to my Schwab Bank Investor Checking™ account? Awarded Best Online Bank of , SoFi Bank offers accounts with high APYs and no account, overdraft, or monthly fees. Open a bank account online today. Pair your Chase Total Checking® account with. Chase Savings SM. Savings made simple with our most popular savings account. Automatically set money aside, earn. Get the best CDs. Earn stellar returns while you stash your cash. Checking accounts. Compare checking options. Find a free checking account. Bonuses. Earn a. Just as with the interest earned on a money market, certificate of deposit, or checking account, the interest earned on savings accounts is taxable income. The. best savings account or CD account to reach your future savings goals A savings account is a bank account where you can store your money and earn interest. We have more ways for your money to earn even more. Choose from CDs, Health Savings Accounts, nationally recognized credit cards and the checking account Money. Top Deposit Links Top Deposit Links. Account Rates · Account Fees · Advantage Banking Clarity Statement · Managing Your Money · Access Your Accounts · Account. Choose the best account for you and enjoy Online Banking, Mobile Banking money when you invest in securities. You should review any planned financial. You can also save money by not having to pay check-cashing fees. 4. You can make online purchases with ease and peace of mind. Some bank accounts provide. Fee-free online savings with one of the nation's top savings interest rates. A kid-friendly savings account for earning interest and growing their money. Make deposits, move money, and do so much more with digital banking. See The cash in your Truist One Savings account may be used to get extra. If you have a Regions checking account, you can save money and earn interest with no monthly fee, no minimum balance requirement and a bonus opportunity. Your life, your money, your choice. Say yes to a checking account that works for you. Make an Appointment · Open Account. in the Account Agreement for Personal Checking, Savings and Money Market Accounts). How do I make deposits? Once you've opened your account, you can deposit. Account balances at a glance; One central location to make payments, transfer funds, send money and more. We hope these changes make banking with us easier than. Establish saving goals with your child — encourage them to dream big! · Track their progress together in the Chase Mobile® app. As they earn or receive money. The interest-bearing Platinum Savings account gives you several easy ways to get to your money when you need it, including online and mobile access.

401 Ira Roth

A MissionSquare a (k) Roth conversion generally refers to converting some or all of your (k) savings to a Roth (k) within your existing plan. The Roth (k) allows you to contribute to your (k) account on an after-tax basis - and pay no taxes on qualifying distributions when the money is. With tax-free earnings and large contribution limits, Roth (k)s are worth considering. Learn about a Roth (k) vs. a traditional (k). For Roth (k)s, it's just the opposite. Your tax burden is higher now, but your retirement income is tax free1. Everything else—the investment options, the. A big difference in (k) vs. Roth IRA is the contribution amount. Also, (k) contributions are tax-deductible; Roth IRA deposits aren't but withdrawals. In this post, we look at some of the benefits and differences of the three most popular retirement options: (k) accounts, Traditional IRAs, and Roth IRAs. Effective for contributions and later, anyone with earned income can open and contribute to a traditional or Roth IRA. For contributions and earlier. Roth (k) contribution limits. The maximum amount you can contribute to a Roth (k) for is $23, if you're younger than age This is an extra. A Roth K helps you pay less in taxes if A) You have many years to retirement (think 10+ for example) B) You will have a higher income in retirement than you. A MissionSquare a (k) Roth conversion generally refers to converting some or all of your (k) savings to a Roth (k) within your existing plan. The Roth (k) allows you to contribute to your (k) account on an after-tax basis - and pay no taxes on qualifying distributions when the money is. With tax-free earnings and large contribution limits, Roth (k)s are worth considering. Learn about a Roth (k) vs. a traditional (k). For Roth (k)s, it's just the opposite. Your tax burden is higher now, but your retirement income is tax free1. Everything else—the investment options, the. A big difference in (k) vs. Roth IRA is the contribution amount. Also, (k) contributions are tax-deductible; Roth IRA deposits aren't but withdrawals. In this post, we look at some of the benefits and differences of the three most popular retirement options: (k) accounts, Traditional IRAs, and Roth IRAs. Effective for contributions and later, anyone with earned income can open and contribute to a traditional or Roth IRA. For contributions and earlier. Roth (k) contribution limits. The maximum amount you can contribute to a Roth (k) for is $23, if you're younger than age This is an extra. A Roth K helps you pay less in taxes if A) You have many years to retirement (think 10+ for example) B) You will have a higher income in retirement than you.

Yes, absolutely. Having both is an effective way to diversify your retirement portfolio. Financial professionals generally recommend taking advantage of (k). A Roth IRA may be right for you if you are · In a lower tax bracket · Wanting more spendable income · Ready to invest at least $1, · Needing flexibility. Yes, under certain circumstances you can have both a k and a Roth IRA. Understand the rules for contributing to a (k) and a Roth IRA, including limits. Yes, you can have a Roth IRA and a (k) if you're eligible for your employer's (k) plan and you qualify to contribute to a Roth IRA. With tax-free earnings and large contribution limits, Roth (k)s are worth considering. Learn about a Roth (k) vs. a traditional (k). Effective for contributions and later, anyone with earned income can open and contribute to a traditional or Roth IRA. For contributions and earlier. Also, PSR (k) and plans have the advantage of higher contribution limits than a Roth IRA. How do Roth contributions affect my take-home pay? After-tax. Unlike traditional (k) contributions, your Roth (k) contributions are included in your taxable income at the time they are made. Since you include your. You can contribute to a (k), an IRA, a Roth IRA, and a Roth (k) all at the same time. In fact, diversifying your accounts can help boost your savings. Contributing to an OregonSaves Roth IRA through payroll deduction offers some tax benefits and consequences. You should consult your tax or financial advisor if. Yes, it could make sense to open a Roth IRA at least five years before you plan to rollover your Roth (k). However, it's not enough to open it. The Roth (k) is a type of retirement savings plan. It was authorized by the United States Congress under the Internal Revenue Code, section A. Both plans offer tax advantages, either now or in the future. With a traditional (k), you defer income taxes on contributions and earnings. Just as with your traditional (k), you may contribute pretax dollars to a traditional IRA and then potentially benefit from tax-deferred growth. Be aware. A Roth (k) is like a traditional (k) with one key exception: Instead of making pre-tax contributions today, your contributions are taxed in the year you. Adding a Roth IRA account to your retirement portfolio provides benefits not available with a traditional (k) plan. k employee contribution limits increase in to $ from $ Those over 50 can make additional catch-up contributions of $ per year to. You can make both Traditional and Roth contributions to a (k), but they share a contribution limit. You can make both Traditional and Roth. An IRA lets you save for retirement outside of work. It generally provides more control and more investment selection. · A (k) is a retirement savings program. You can leverage a Roth (k) account in combination with your traditional (k) account for maximal retirement planning and tax savings.

Can You Borrow Against Your House

Yes, property owners commonly borrow money against a house to invest in another. This is the case if it's a buy to let or a new home for you to live in. When. You can get a home equity line of credit, also known as a "HELOC." You can get a cash out refinance, where you replace your current mortgage with a new. A home equity loan, also known as a second mortgage, enables you as a homeowner to borrow money by leveraging the equity in your home. A HELOC is a revolving line of credit that allows you to borrow against the equity in your home, typically at a much lower interest rate than a traditional. Home equity is the difference between how much you owe on your mortgage and how much your home is worth. Navy Federal has home equity loan options that could. Where's your property located? Provincial and territorial guidelines help determine how much of your home equity you can access. You may qualify to borrow. For all those, you typically will only be approved to borrow up to 80% of your homes value (including all loans secured by the property). So if. The home equity loan is second in line to be repaid if you default on your mortgage and the lender forecloses on your home. There are no limits on how you can. You can borrow against your home's equity in three ways. One way to access the equity in your home is through a cash out refinance. Yes, property owners commonly borrow money against a house to invest in another. This is the case if it's a buy to let or a new home for you to live in. When. You can get a home equity line of credit, also known as a "HELOC." You can get a cash out refinance, where you replace your current mortgage with a new. A home equity loan, also known as a second mortgage, enables you as a homeowner to borrow money by leveraging the equity in your home. A HELOC is a revolving line of credit that allows you to borrow against the equity in your home, typically at a much lower interest rate than a traditional. Home equity is the difference between how much you owe on your mortgage and how much your home is worth. Navy Federal has home equity loan options that could. Where's your property located? Provincial and territorial guidelines help determine how much of your home equity you can access. You may qualify to borrow. For all those, you typically will only be approved to borrow up to 80% of your homes value (including all loans secured by the property). So if. The home equity loan is second in line to be repaid if you default on your mortgage and the lender forecloses on your home. There are no limits on how you can. You can borrow against your home's equity in three ways. One way to access the equity in your home is through a cash out refinance.

If your mortgage is paid off, you can take out a home equity loan; it may even improve your approval odds. Home improvements: HELOCs are an attractive financing option if you're thinking about upgrading or you have to make necessary repairs to your property. · Major. A home equity loan is like a second mortgage, allowing you to borrow against your property assuming there is enough equity available. How much equity can I. If you're a homeowner in need of credit, borrowing against your home's equity can be a great option. A home equity loan and a home equity line of credit. You can borrow against the equity in your home for any purpose you wish, including buying another home, but there are some risks to consider first. This means that the more you borrow, the higher the risk. Taking out a second mortgage will also lower the amount of equity you have in your home. Before you. Whether you want to move into a bigger home, reduce or refinance your mortgage or use your home equity to borrow and save, you'll find a range of articles. This means if you don't repay the financing, the lender can take your home as payment for your debt. Refinancing your home, getting a second mortgage, taking. A home equity loan is a secured loan – lenders loan you the money secured against the value of your home. They are sometimes referred to as homeowner loans. An. Home improvements: HELOCs are an attractive financing option if you're thinking about upgrading or you have to make necessary repairs to your property. · Major. With a HELOC, you're borrowing against the available equity in your home and the house is used as collateral for the line of credit. As you repay your. Cash-out refinancing, which replaces your current mortgage loan with a larger one and gives you the difference in cash. The more equity you have, the more cash. Yes. If you own the land outright, you have % equity and can still borrow against that equity with a land equity loan. The amount you're allowed to borrow. Mortgage lenders look closely at your funding sources and may not allow you to use the money borrowed against one house to help fund a mortgage on another—. A home equity loan, also known as a second mortgage, is a debt that is secured by your home. Generally, lenders will let you borrow no more than 80% of the. A home equity loan is a mortgage that sits on top of your current first mortgage as a completely separate loan. It lets you use the remaining. This means if you don't repay the financing, the lender can take your home as payment for your debt. Refinancing your home, getting a second mortgage, taking. This has already been covered. But before looking at you as a candidate for the loan, the lender will look at the property. They want the loan-to-value ratio to. If you've paid off a significant portion of your mortgage, you may be eligible to borrow against that equity using a home equity loan. This can be especially. A home equity loan, also known as a second mortgage, enables you as a homeowner to borrow money by leveraging the equity in your home.

What Is Fixed Income Products

Types of Income · Fixed Coupon Bonds · Step-Up Bonds · Floating Rate Bonds · Fixed to Float · Zero Coupon Bonds. Investors traditionally equate bonds with fixed income however there are various types of fixed income instruments including preferred securities, treasury. Fixed-income securities are debt instruments issued by a government, corporation or other entity to finance and expand their operations. These products are typically debt securities issued by governments, corporations, or other entities to raise capital. They are called "fixed income" because. Our money market indices are designed to track the performance of securities publicly issued by North American, European, Asian, Pan Asian, Oceanian, and Latin. 'Fixed income' is a broad asset class that includes government bonds, municipal bonds, corporate bonds, and asset-backed securities such as mortgage-backed. Fixed income securities are a broad class of very liquid and highly traded debt instruments, the most common of which is a bond. The term "fixed" in "fixed income" refers to both the schedule of obligatory payments and the amount. "Fixed income securities" can be distinguished from. Our range of fixed income products Treasury notes and bonds: U.S. Government debt that carries a fixed interest rate, usually with a maturity of years. Types of Income · Fixed Coupon Bonds · Step-Up Bonds · Floating Rate Bonds · Fixed to Float · Zero Coupon Bonds. Investors traditionally equate bonds with fixed income however there are various types of fixed income instruments including preferred securities, treasury. Fixed-income securities are debt instruments issued by a government, corporation or other entity to finance and expand their operations. These products are typically debt securities issued by governments, corporations, or other entities to raise capital. They are called "fixed income" because. Our money market indices are designed to track the performance of securities publicly issued by North American, European, Asian, Pan Asian, Oceanian, and Latin. 'Fixed income' is a broad asset class that includes government bonds, municipal bonds, corporate bonds, and asset-backed securities such as mortgage-backed. Fixed income securities are a broad class of very liquid and highly traded debt instruments, the most common of which is a bond. The term "fixed" in "fixed income" refers to both the schedule of obligatory payments and the amount. "Fixed income securities" can be distinguished from. Our range of fixed income products Treasury notes and bonds: U.S. Government debt that carries a fixed interest rate, usually with a maturity of years.

Fixed income securities also carry inflation risk, liquidity risk, call risk, and credit and default risks for both issuers and counterparties. Unlike. Fixed income trading involves the buying and selling of fixed income securities by fixed income investors. Fixed income securities include bonds such as. Invesco has many fixed income strategies to help you meet your goals, including taxable bonds, tax-free municipals, mutual funds, ETFs, and SMAs. Fixed income securities, or bonds, are investments that typically provide a relatively predictable stream of cash flows to investors as long as the bond issuer. Fixed-income investments such as bonds, are securities where you lend money in exchange for regular interest payments and the return of your principal. Individual loans or fixed-income obligations may be bundled into a pool of assets supporting such instruments as asset-backed securities and covered bonds. Fixed income products, such as guaranteed investment certificates (GICs), bonds and money market securities, typically generate a predictable stream of. Fixed income is an asset class that is a commonly held investment because it helps preserve capital. Fixed-income investments, or bonds as they are commonly. Fixed income securities yield guaranteed returns on investments. They act as a liability for the organisation launching them in the market. Returns on fixed-. Fixed Income describes securities where investors provide capital to corporations or a government for a set duration in return for regular interest payments and. Before the bond is due, investors are liable to receive coupon payments regularly, which explains why bonds are also called fixed-income products. Take a. Fixed income mutual funds—commonly referred to as income funds—are a type of mutual fund that holds a basket of fixed income securities, such as government. Help boost clients' bottom lines · We're one of the world's largest managers of fixed income securities, with $ trillion in assets as of June 30, · 15 of. Fixed income is an asset class, like cash, real estate, commodities, equities and currencies. Fixed income is also considered a debt investment, meaning. Understand and gain confidence working with fixed-income instruments including bonds, loans, and structured products · Learn how to identify and quantify the. The most commonly known fixed income investments are government and corporate bonds, but CDs and money market funds are also types of fixed income. How bonds. A fixed income is a type of investment security that provides investors a regular and steady stream of income. It pays investors fixed interest payments over a. FINRA plays an important role in regulating and providing transparency to the fixed income securities markets. For example, we operate and enforce FINRA. HSBC Securities has a fixed-income investment solution for every need. Contact an HSBC Securities Financial Professional today to plan a fixed income. Fixed income investments · Tax-exempt and taxable municipal securities · Mortgage-backed securities (MBS) · Collateralized mortgage obligations (CMOs) · Asset-.

How Much Are Penalties On 401k

Assumptions include a 10% federal tax withholding, 5% state tax withholding, and a 10% early withdrawal penalty, for a total of 25%. Given the listed. Unfortunately, there's usually a 10% penalty—on top of the taxes you owe—when you withdraw money early. This is where the rule of 55 comes in. If you turn 55 . Use this calculator to estimate how much in taxes and penalties you could owe if you withdraw cash early from your (k). If you're less than 59 ½ years old, the IRS normally assesses an additional 10% penalty. That means you'll need to pay another $1, when you file your tax. Anyone who withdraws from their (K) before they reach the age of 59 1/2, they will have to pay a 10% penalty along with their regular income tax. Learn how you may avoid the 10% early withdrawal penalty when taking money from your retirement account. You can withdraw funds from a (k) anytime. But withdrawals before age 59½ can mean a 10% penalty. Learn more about the (k) withdrawal rules. You can take money from your (k) account if you are age 59½ or older. You will not have a penalty. Twenty percent is withheld for federal income taxes. You. Total liability should be about $2,$2, You withheld (pre-paid) 20% + 10% for penalty (30% total). There's a good chance you will not owe. Assumptions include a 10% federal tax withholding, 5% state tax withholding, and a 10% early withdrawal penalty, for a total of 25%. Given the listed. Unfortunately, there's usually a 10% penalty—on top of the taxes you owe—when you withdraw money early. This is where the rule of 55 comes in. If you turn 55 . Use this calculator to estimate how much in taxes and penalties you could owe if you withdraw cash early from your (k). If you're less than 59 ½ years old, the IRS normally assesses an additional 10% penalty. That means you'll need to pay another $1, when you file your tax. Anyone who withdraws from their (K) before they reach the age of 59 1/2, they will have to pay a 10% penalty along with their regular income tax. Learn how you may avoid the 10% early withdrawal penalty when taking money from your retirement account. You can withdraw funds from a (k) anytime. But withdrawals before age 59½ can mean a 10% penalty. Learn more about the (k) withdrawal rules. You can take money from your (k) account if you are age 59½ or older. You will not have a penalty. Twenty percent is withheld for federal income taxes. You. Total liability should be about $2,$2, You withheld (pre-paid) 20% + 10% for penalty (30% total). There's a good chance you will not owe.

On top of the 10% penalty, you'll owe taxes on the amount you withdraw from your (k). Your plan administrator is required to withhold 20% of your withdrawal. However, when you take an early withdrawal from a (k), you could lose a significant portion of your retirement money right from the start. Income taxes, a There is no penalty on hardship withdrawals. It's just included as ordinary income. Must be “immediate and heavy” need. You're right though. How to Avoid Early Withdrawal Penalties. Early withdrawal penalties deduct 10% of the money that you withdraw. When you pair those penalties with your tax. Dipping into a (k) or (b) before age 59 ½ usually results in a 10% penalty. For example, taking out $20, will cost you $ Calculate How Much it Will Cost You to Cash Out Funds Early From Your IRA or k Retirement Plan. Early Retirement Account Withdrawal Tax Penalty. Taking distributions before reaching age 59½ may subject one to a 10% tax penalty, in addition to income taxes, unless one meets one of the exceptions to the. Learn how you may avoid the 10% early withdrawal penalty when taking money from your retirement account. Know how current k withdrawal penalties could affect your account, or call us toll-free at () for free, personalized assistance. Roth IRA: Ability to withdraw contributions (not earnings) without incurring a 10% early withdrawal penalty. Tax Rates and Traditional vs. Roth IRAs. If tax. If you withdraw money from your plan before age 59 1/2, you might have a 10% early withdrawal penalty. However, there are exceptions to this early distribution. Unfortunately, there's usually a 10% penalty—on top of the taxes you owe—when you withdraw money early. This is where the rule of 55 comes in. If you turn 55 . If you withdraw from a traditional IRA or (k) before this age, those withdrawals are subject to a 10% early withdrawal penalty and taxation at ordinary. In addition to normal income tax, you will owe a 10% penalty of additional tax on the amount of the early withdrawal in unless you meet an exception. Thinking of tapping into your retirement savings early? · A $2, 10% early withdrawal penalty · $5, in federal income taxes. Key Takeaways · If you are under 59½, you will incur a 10% early withdrawal penalty and owe regular income taxes on the distribution. · A withdrawal penalty is. If you took a distribution from your (k) or another qualified retirement plan (excluding IRAs) before you turned 59 1/2, you'll pay a 10% early withdrawal. Withdrawals from a (k) plan may result in several types of tax, and you need to understand all of them. In many cases, you'll have to pay federal and state taxes on your early withdrawal, plus a possible 10% tax penalty. Individual retirement accounts (IRAs), (k)s and certificates of deposit are the most common investments that carry early withdrawal penalties.

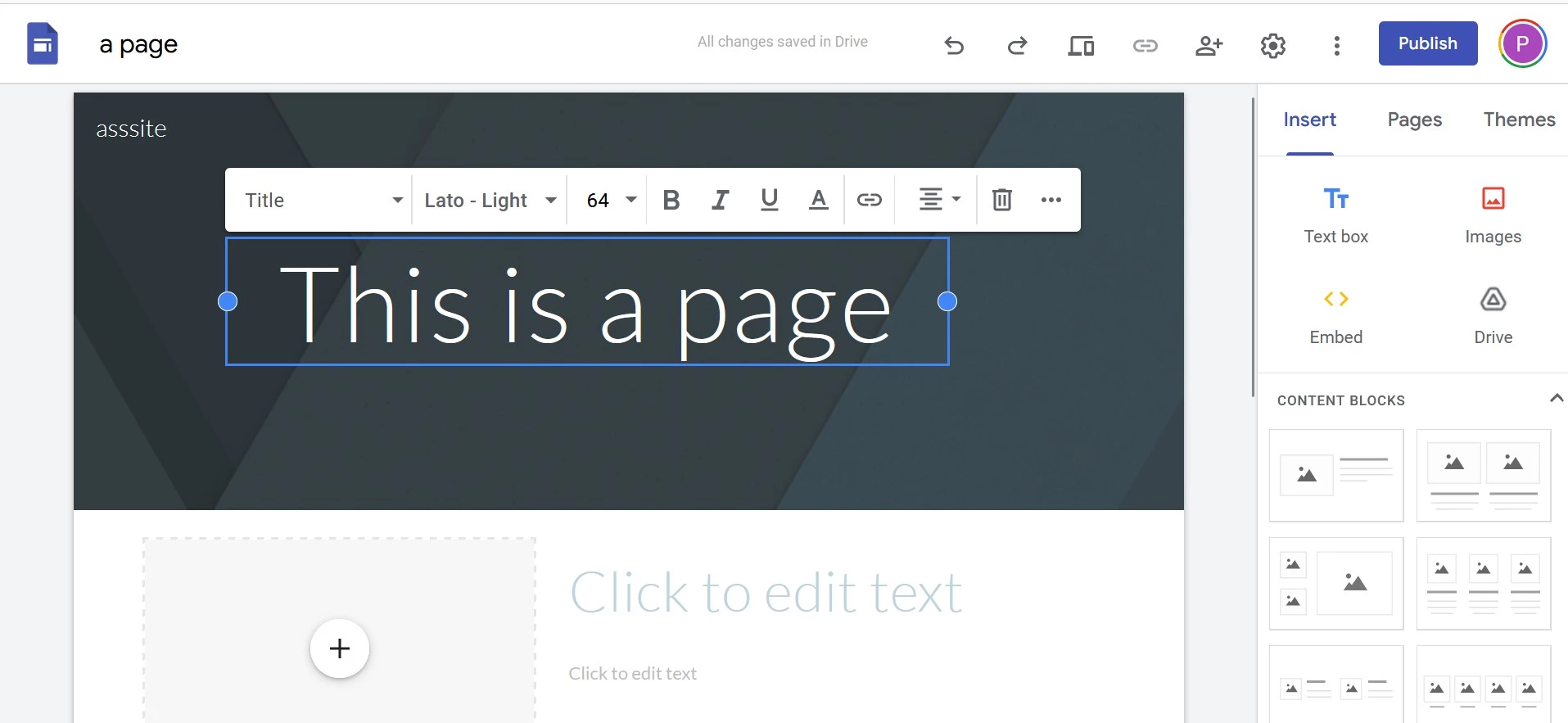

Google Sites Vs Blogger

GOOGLE SITES, which seems like something they'd rather not do:) -JP -- -- You received this message because you are subscribed to the Google Groups. GOOGLE SITES, which seems like something they'd rather not do:) -JP -- -- You received this message because you are subscribed to the Google Groups. Blogger is optimized for blogging, Sites is more for sharing across a web platform or making a small website (like for a restaurant) I believe. Google Sites is the easier of both platforms to use. Users can get started right away without having any prior experience or knowledge on how to build a website. If you want to create a blog then Blogger is recommended, and if you want to create a good Landing page you can go with Google Sites. It was founded in and later acquired by Google. You can instantly start a new blog site on this platform using a quick and easy integration with your. Which is better for blogging, WordPress or Google Sites? Blogger is a blogging platform, that was bought by Google in All blogs created within this platform are housed within Google servers. While there are many blogging platforms available, Google Sites offers a unique and user-friendly approach to creating and hosting a blog. With. GOOGLE SITES, which seems like something they'd rather not do:) -JP -- -- You received this message because you are subscribed to the Google Groups. GOOGLE SITES, which seems like something they'd rather not do:) -JP -- -- You received this message because you are subscribed to the Google Groups. Blogger is optimized for blogging, Sites is more for sharing across a web platform or making a small website (like for a restaurant) I believe. Google Sites is the easier of both platforms to use. Users can get started right away without having any prior experience or knowledge on how to build a website. If you want to create a blog then Blogger is recommended, and if you want to create a good Landing page you can go with Google Sites. It was founded in and later acquired by Google. You can instantly start a new blog site on this platform using a quick and easy integration with your. Which is better for blogging, WordPress or Google Sites? Blogger is a blogging platform, that was bought by Google in All blogs created within this platform are housed within Google servers. While there are many blogging platforms available, Google Sites offers a unique and user-friendly approach to creating and hosting a blog. With.

Ok – Blogger is an old-school but still surprisingly good blogging platform. You can create a website with it. You can do designs, templates, and everything. Compare Blogger vs. Google Sites vs. Microsoft Sway in by cost, reviews, features, integrations, deployment, target market, support options, trial offers. blogging platforms such as WordPress or Blogger. Creating a successful blog requires consistent, high-quality content, effective marketing. In popular culture we most often hear about news blogs or celebrity blog sites If you implement Google Adsense or a Google Analytics account on your blog. Compare Blogger vs. Google Sites using this comparison chart. Compare price, features, and reviews of the software side-by-side to make the best choice for. Blogger is a blogging-focused platform with easy setup and customization options, whereas Google Sites offers a broader range of functionalities. Squarespace: Squarespace is a website builder known for its clean and modern templates, e-commerce capabilities, and blogging tools. Pros include professional. How to read the diagram: Blogger is used by % of all the websites whose content management system we know. Blogger is used by % of all the websites whose. Create eye-catching Blogger Feed for Google Sites & Improve the user experience on your website. It's free, easily customizable & mobile-friendly. WordPress is generally better than Blogger for SEO. WordPress offers a wider range of SEO tools and plugins, like Yoast SEO, that provide advanced optimization. It would be great to have this feature when GW is connected to Blogger. Such an autonomy in terms of managing the look and functionality at the same time, might. Google Sites does not have a special feature just for blogging. But wait, don't be sad! You can still make a blog using Google Sites. You just. Google Sites vs Blogger Review: Comparing 2 Free Site Builders zhustudio.online At first, you might think that we're talking about Blogger, but in reality, that is a separate tool that we won't cover here. Google Sites is a neat online tool. Deciding between Google Sites and Blogger ultimately depends on your specific needs and goals. If you are looking to create a more comprehensive website with. Create a Responsible Blog with Google Sites. Create a blog for a blogger. Build a website and write an introduction for the blog. Share. Example outcome. Blogger offers integration with other Google services and is relatively easy to monetize. zhustudio.online, though less full-featured than its self-hosted. Because it's part of Google Apps, you don't need a domain name or hosting to set up your site. (You can of course add a domain to Google Sites as well) You can. If you are a keen to write content and develop a blogging website, you have two options. Either you can prefer to Blogger platform or the. A blog is whatever you want it to be; it could be a diary, a collaborative space, or even an outlet to show off your cooking skills. You can share your blog.

Pge Stock

Discover real-time Pacific Gas & Electric Co. Common Stock (PCG) stock prices, quotes, historical data, news, and Insights for informed trading and. PCG - PG&E Corp. - Stock screener for investors and traders, financial visualizations. Stock Quote · Stock Quote: NYSE · Stock Chart · Historical Stock Quote · NYSE: PCG · QuickLinks · Shareholder Information · Investor Relations Contact Info. Get PG&E Corp (PCG) real-time stock quotes, news, price and financial information from Reuters to inform your trading and investments. Market capitalization, also called net worth, is the total value of all of a company's outstanding shares. It is calculated by multiplying the stock price by. View Pacific Gas & Electric Co PCG investment & stock information. Get the latest Pacific Gas & Electric Co PCG detailed stock quotes, stock data. Get PG&E Corp (PCG:NYSE) real-time stock quotes, news, price and financial information from CNBC. The PG&E Corp stock price today is What Is the Stock Symbol for PG&E Corp? The stock ticker symbol for PG&E Corp is PCG. Is PCG the Same as $PCG? What. PG&E Raises $ Billion to Near Bankruptcy Exit The California utility issued a common stock offering at $ per share as well as a separate sale of equity. Discover real-time Pacific Gas & Electric Co. Common Stock (PCG) stock prices, quotes, historical data, news, and Insights for informed trading and. PCG - PG&E Corp. - Stock screener for investors and traders, financial visualizations. Stock Quote · Stock Quote: NYSE · Stock Chart · Historical Stock Quote · NYSE: PCG · QuickLinks · Shareholder Information · Investor Relations Contact Info. Get PG&E Corp (PCG) real-time stock quotes, news, price and financial information from Reuters to inform your trading and investments. Market capitalization, also called net worth, is the total value of all of a company's outstanding shares. It is calculated by multiplying the stock price by. View Pacific Gas & Electric Co PCG investment & stock information. Get the latest Pacific Gas & Electric Co PCG detailed stock quotes, stock data. Get PG&E Corp (PCG:NYSE) real-time stock quotes, news, price and financial information from CNBC. The PG&E Corp stock price today is What Is the Stock Symbol for PG&E Corp? The stock ticker symbol for PG&E Corp is PCG. Is PCG the Same as $PCG? What. PG&E Raises $ Billion to Near Bankruptcy Exit The California utility issued a common stock offering at $ per share as well as a separate sale of equity.

See the latest PG&E Corp stock price (PCG:XNYS), related news, valuation, dividends and more to help you make your investing decisions. Based on 8 Wall Street analysts offering 12 month price targets for PG&E in the last 3 months. The average price target is $ with a high forecast of $ On average, Wall Street analysts predict that PG&E's share price could reach $ by Aug 23, The average PG&E stock price prediction forecasts a. PG&E Share Price Live Today:Get the Live stock price of PCG Inc., and quote, performance, latest news to help you with stock trading and investing. 54 minutes ago. Key Stock Data · P/E Ratio (TTM). (08/22/24) · EPS (TTM). $ · Market Cap. $ B · Shares Outstanding. B · Public Float. B · Yield. %. Track PG&E Corp. (PCG) Stock Price, Quote, latest community messages, chart, news and other stock related information. Share your ideas and get valuable. To purchase shares of PG&E Corporation common stock, you may log in to EQ Shareowner Services at zhustudio.online to purchase shares through the Dividend. PG&E Corp. is a holding company, which engages in generation, transmission, and distribution of electricity and natural gas to customers. It specializes. PG&E Corporation's revenue estimate for is $B. The latest low revenue estimate is $B and the high revenue estimate is $B. Learn more about. Complete PG&E Corp. stock information by Barron's. View real-time PCG stock price and news, along with industry-best analysis. PG&E Corp. historical stock charts and prices, analyst ratings, financials, and today's real-time PCG stock price. PG&E Corporation (NYSE:PCG) institutional ownership structure shows current positions in the company by institutions and funds, as well as latest changes in. View PG&E Corporation PCG stock quote prices, financial information, real-time forecasts, and company news from CNN. In depth view into PG&E Stock Buybacks (Quarterly) including historical data from , charts and stats. The latest PG&E stock prices, stock quotes, news, and PCG history to help you invest and trade smarter. PG&E Corp. operates as a holding company, which engages in generation, transmission, and distribution of electricity and natural gas to customers. Research PG&E's (NYSE:PCG) stock price, latest news & stock analysis. Find everything from its Valuation, Future Growth, Past Performance and more. zhustudio.online PG&E is a holding company whose main subsidiary is Pacific Gas and Electric, a regulated utility operating in Central and Northern. PG&E Corp. is the parent holding company of California's largest regulated electric and gas utility, Pacific Gas and Electric Company. The utility generates.

Sell Used Cell Phone Kiosk

Want to trade in your old device? Check out Gazelle's easy selling options & find the one for you! Get free shipping and fast payment if you order today! The best place to sell cell phones WikiWoo can buy your cell phone online or you can visit any of our four convenient mall locations. Nobody pays you more. Earn cash for your used phone. Discover a simpler way to sell devices, while helping to create a greener planet. Playing in picture-in-picture. Are you looking to Sell old Mobile Phones Online at Best Prices? Check the best value of your used cell phone at the Dr. phone Fix store. Buy and sell used and refurbished tech, unlocked phones, laptops, video games, new and used sneakers, and more on Swappa! Welcome to the world's safest. Alma School Pawn is the leader in used cell phones where we buy and sell old phones for cash. If you're looking to upgrade or just shop around in Mesa. Sell phone for cash today in 4 simple steps: Enter the make and model of the cell phone you want to sell in the search box above; SellCell instantly compares. No auctions or fees! Pack your cell phone into a box and ship it for FREE with UPS; We'll pay by Direct Deposit or PayPal when your items are processed. The brand new ecoATM app offers many features that make selling or recycling your smartphones a breeze. It provides a safe, secure, and convenient way for you. Want to trade in your old device? Check out Gazelle's easy selling options & find the one for you! Get free shipping and fast payment if you order today! The best place to sell cell phones WikiWoo can buy your cell phone online or you can visit any of our four convenient mall locations. Nobody pays you more. Earn cash for your used phone. Discover a simpler way to sell devices, while helping to create a greener planet. Playing in picture-in-picture. Are you looking to Sell old Mobile Phones Online at Best Prices? Check the best value of your used cell phone at the Dr. phone Fix store. Buy and sell used and refurbished tech, unlocked phones, laptops, video games, new and used sneakers, and more on Swappa! Welcome to the world's safest. Alma School Pawn is the leader in used cell phones where we buy and sell old phones for cash. If you're looking to upgrade or just shop around in Mesa. Sell phone for cash today in 4 simple steps: Enter the make and model of the cell phone you want to sell in the search box above; SellCell instantly compares. No auctions or fees! Pack your cell phone into a box and ship it for FREE with UPS; We'll pay by Direct Deposit or PayPal when your items are processed. The brand new ecoATM app offers many features that make selling or recycling your smartphones a breeze. It provides a safe, secure, and convenient way for you.

Phone Trade-In Sell More Phones. Best Selling Phones September Phone, Price Range sell your phone, most offering only store credit. Instead of trading. Are you looking to sell your current device, upgrade your phone, or have an unused phone or two sitting in a drawer? Turn your phone into cash at Mobile. Sell your phone, tablet, or laptop for more cash online without the hassle of auctions. Instant quote, we pay shipping. The brand new ecoATM app offers many features that make selling or recycling of all of your used smartphones a breeze. In combination with over kiosks. They normally want you to do a factory reset on the phone before putting it into the machine. So they probably aren't selling data. Learn how to get top dollar for your cell phones and accessories with eBay's Cell Phone Selling Guide--flip phones, camera phones, smartphones, headsets. Sell your smartphone for cash today at The Austin Cell Phone. We buy them in new, used and sometimes broken conditions. New versions of the smartphone come. There is a Cellairis store near Fort Lauderdale that will give you cash today for those old phones and tablets. Open for business. Like a boss. Interested in selling your old iPhone, iPad or smartphone for trade-in credit? your trade-in credits towards an upgrade in-store. Visit Cell Phone Repair. We Have MOVED.. New Used Cell Phone Store With MORE Inventory! Phone Xchange would like to thank all of our customers in Portland & Clackamas for helping us get. Decluttr is a direct-buyer marketplace that pays a decent amount for old phones, plus a host of other tech and non-tech goods. Decluttr's main differentiator is. Does anyone know how much you can get for an old cell phone in one of these, Sell your old cell phone, machines I keep seeing when I walk in? Eugene, Sell Your iPhones, Cell Phones or iPads to Us You can also take the earned cash and look around our retail store to find the perfect case to protect. Top 10 Best Where to Sell Used Cell Phones in San Jose, CA - September - Yelp - Phone Repair Shack, Phone Hut Cell Phone Repair, Zac's Quick Fix Phone. Are you trying to sell your old iPhone, iPad or any other type of smartphone or tablet to CPR Cell Phone Repair Merrillville, IN? Learn more about selling. Buy And Sell Used Phones. Certified, Refurbished Phones And Devices. iPhones, Samsungs, Pixels, Macbooks, Apple Watches, and More! At CommDepot we strive to think green. If you have an old cell phone or tablet that you are willing to sell – we are here to help you turn those devices. If you're looking for a refurbished electronics store in Eden Prairie, MN, that makes it easy to buy and sell used cell phones, Wamatek has your back. Icon. You can sell your used iPhone, Samsung phone, Goog Sell My Phone Fast. The online market for pre-owned cell phones is thriving. When you. We Have MOVED.. New Used Cell Phone Store With MORE Inventory! Phone Xchange would like to thank all of our customers in Portland & Clackamas for helping us get.

Carbon Credit Etf Us

The BlackRock US Carbon Transition Readiness ETF (the “Fund”) seeks long-term capital appreciation by investing in large-and mid-capitalization US equity. Fossil Free Funds analyzes the fossil fuel exposure and carbon footprint of thousands of US mutual funds and ETFs. We make it easy to know what you own. Carbon Allowances track the price changes of carbon credits, also known as “cap and trade.” These allowances are used as economic incentives for companies. Operating a vertically integrated issuing program, registry, and marketplace enables us to provide buyers with comprehensive data about each credit, from. fund investment in climate technology. Carbon pricing can also be implemented through emissions trading About Us. About F&D Magazine · Contact Us. Social. carbon exposure as compared to the Bloomberg Year U.S. Aggregate Bond Index. It is not possible to invest directly in an index. Exchange Traded Funds (ETFs). The BlackRock US Carbon Transition Readiness ETF (the “Fund”) seeks long-term capital appreciation by investing in large-and mid-capitalization US equity. Product Type: ETF. Country/Region: NYSE Arca. Ticker: LABD. No index-linked Contact Us; Customer Care & Sales · Support by Division · Report an Ethics. This ETF is suitable for investors willing to invest in highly speculative investments and are comfortable with a high degree of risk. Portfolio Diversification. The BlackRock US Carbon Transition Readiness ETF (the “Fund”) seeks long-term capital appreciation by investing in large-and mid-capitalization US equity. Fossil Free Funds analyzes the fossil fuel exposure and carbon footprint of thousands of US mutual funds and ETFs. We make it easy to know what you own. Carbon Allowances track the price changes of carbon credits, also known as “cap and trade.” These allowances are used as economic incentives for companies. Operating a vertically integrated issuing program, registry, and marketplace enables us to provide buyers with comprehensive data about each credit, from. fund investment in climate technology. Carbon pricing can also be implemented through emissions trading About Us. About F&D Magazine · Contact Us. Social. carbon exposure as compared to the Bloomberg Year U.S. Aggregate Bond Index. It is not possible to invest directly in an index. Exchange Traded Funds (ETFs). The BlackRock US Carbon Transition Readiness ETF (the “Fund”) seeks long-term capital appreciation by investing in large-and mid-capitalization US equity. Product Type: ETF. Country/Region: NYSE Arca. Ticker: LABD. No index-linked Contact Us; Customer Care & Sales · Support by Division · Report an Ethics. This ETF is suitable for investors willing to invest in highly speculative investments and are comfortable with a high degree of risk. Portfolio Diversification.

The Fund invests in Carbon Futures from the United States and Europe. As the global carbon credit market grows, the Fund may invest in Carbon Futures linked. TD Global Carbon Credit Index ETF. $ TCBN %. Capital 16 minutes ago. US stocks close lower, comeback rally stalls as investors remain cautious. Several carbon markets have been set up for the purpose of trading these assets, including in Québec, Western Europe, a number of U.S. states, New Zealand. Vanguard ETFs as a share class: Vanguard ETFs® (exchange-traded funds) are a class of shares listed for trading on an exchange. The shares are available. A list of all carbon credit ETFs/ETCs with details on size, cost, age, income, domicile and replication method ranked by fund size. Clean Energy ETF (ZERO) is Europe';s first ETF which includes carbon offsetting and will allow investors to neutralise their investment';s carbon footprint. Carbon offsets in this category fund projects of three main types. ICROA's membership consists of carbon offset providers based in the United States. Key risks. An investment in VanEck Global Carbon Credits ETF (Synthetic) carries risks associated with: ASX trading time differences, market risk, concentration. The iShares Government/Credit Bond ETF (GBF) seeks to track the investment results of an index composed of U.S. dollar-denominated government. This dashboard provides charts for allowance allocation, ARB offset credit issuance, auction data, market activity, and the Voluntary Renewable Electricity. Vanguard ESG U.S. Stock ETF ESGV has a carbon footprint of 34 tonnes CO2 / $1M USD invested. Vanguard ESG U.S. Stock ETF ESGV has a carbon footprint of 34 tonnes CO2 / $1M USD invested. carbon market reached US$ billion in Energy consulting firm Wood Mackenzie estimates that the global emissions trading market could be worth as much. %. VIEW ALL ETFs CONTACT US. QUICK LINKS. pdf. Factsheet. Our Approach. Our The NAV is not necessarily the same as the ETF 's intraday trading value. Explore U.S. ETFs · Estimate trading costs · View all tools. About Us. About Us. GET TO KNOW iSHARES; About us · Contact us. United States. Change location. Effective July 29, , TD U.S. Equity Portfolio was renamed to TD U.S. Equity Pool. TD Mutual Funds are qualified for sale in the provinces and territories of. For example, the Fund may invest in carbon credit futures with U.S. issuers or other securities or instruments that have lower trading volumes. The number of emissions trading systems around the world is increasing. Besides the EU emissions trading system (EU ETS), national or sub-national systems are. State Street Institutional U.S. Government Money Market Fund Institutional Cl The Fund attempts to maintain exposure to carbon credit futures that are the. The Center for Carbon Transition enables us to leverage the best of our credit or to provide any other products or services to any person or entity.

Should I Lock Into A Fixed Rate Mortgage

Flexibility is definitely the greatest asset to a variable rate. You don't need to worry about penalties if you want to increase your monthly mortgage repayment. If you have a surplus right now, you should be considering either locking in or opting for a variable rate with a discount. If you have a healthy discount. The most obvious reason you should lock your rate is so it doesn't change before your closing. A higher rate means more than just a higher monthly payment and. Usually a lender will ask you whether you want to lock your rate when you submit your loan application. If rates are low, locking a rate early in the loan. If you are comfortable with and the costs are reasonable, lock away. You'll sleep better knowing that you've secured your payment details. Interest rates change frequently, often daily or even multiple times a day. A small change in your rate could mean significant changes in the interest paid over. If interest rates are high and expected to fall, an ARM will help you take advantage of the drop, as you're not locked into a particular rate. If interest rates. If rates are low, it would make more sense to get a fixed-rate mortgage to lock in the low rate. When Should You Consider Refinancing to a Fixed-Rate Mortgage. You can choose either a fixed rate or fluctuating rate. Not all banks will allow you to lock in a mortgage rate. If you want to pay the same. Flexibility is definitely the greatest asset to a variable rate. You don't need to worry about penalties if you want to increase your monthly mortgage repayment. If you have a surplus right now, you should be considering either locking in or opting for a variable rate with a discount. If you have a healthy discount. The most obvious reason you should lock your rate is so it doesn't change before your closing. A higher rate means more than just a higher monthly payment and. Usually a lender will ask you whether you want to lock your rate when you submit your loan application. If rates are low, locking a rate early in the loan. If you are comfortable with and the costs are reasonable, lock away. You'll sleep better knowing that you've secured your payment details. Interest rates change frequently, often daily or even multiple times a day. A small change in your rate could mean significant changes in the interest paid over. If interest rates are high and expected to fall, an ARM will help you take advantage of the drop, as you're not locked into a particular rate. If interest rates. If rates are low, it would make more sense to get a fixed-rate mortgage to lock in the low rate. When Should You Consider Refinancing to a Fixed-Rate Mortgage. You can choose either a fixed rate or fluctuating rate. Not all banks will allow you to lock in a mortgage rate. If you want to pay the same.

When Should Homebuyers Lock in a Rate? Homebuyers may want to consider locking in a mortgage rate when they are concerned about potential fluctuations in. However, longer rate locks are sometimes for slightly higher interest rates or come with an upfront cost. Most borrowers wait until they have signed a contract. This is called “repricing” your loan. Before you can close on your loan, you'll need to lock in a final interest rate. Tip. Fixed-rates Provide Peace of Mind. If the risk of rising rates worries you, then you should consider a fixed-rate mortgage rate term. Locking in your rate. Rate locks are typically days. Locking in for 7 months is a long time and puts the lender at substantial risk -- by the time 7 months. The most obvious reason you should lock your rate is so it doesn't change before your closing. A higher rate means more than just a higher monthly payment and. When you lock in a mortgage rate, you are guaranteed that interest rate, assuming your loan actually qualifies under said lender or bank's guidelines. And as. If you're buying a home, locking in a rate early in the mortgage process may help you feel confident that your payment may not go above what you can afford. You. A mortgage rate lock means your interest rate won't change between the loan offer and closing, provided you close on time and don't change your application. The answer is no, you would lock in at the best fixed posted rate at the time but you want to be careful because if your mortgage has been secured with a. If you plan to sell your home in less than five years, or before the adjustment period of the loan, an ARM may make sense so you can take advantage of lower. We DO allow you to lock a rate before you're in contract, but there are some important caveats that you should know as a consumer: A “TBD” lock. Key point: Although not a scientific study, experience has shown that those that lock their loan early in the transaction tend to end up with a. If your new construction house is already built, opt for a day mortgage rate lock after signing a purchase agreement. This should get you to your closing. A mortgage rate lock freezes your interest rate for a set time, protecting you if it rises. As a result, you know how much your loan will cost before closing. Protect yourself from an unexpected interest rate increase and change in mortgage payment, which would happen if market rates went up, and you were not locked. Mortgage rates typically rise and fall, so if you're offered a low one, locking it in can be a good idea. Learn how a mortgage rate lock works. You can float your rate down after your rate lock only if the following scenarios apply, and it would cost a % hit to your closing costs ( x Loan Size). If interest rates go up after you've locked in, this is a win for you since the mortgage rate lock protects you against rate increases. So if rates rise while. Locking in a low fixed interest rate can be an appealing option to gain peace of mind with certainty in your repayments. Whilst fixing your loan is a great.